I. Overview: Designing a Go-To-Market (GTM) Interim Relief Framework.

Commissioner Peirce recently put out a high level list of priorities the SEC’s crypto task force is exploring entitled ‘The Journey Begins’. Many of these priorities and the themes they explore aligned with a go-to-market framework (GTM Framework) for interim relief I had already been envisioning given that fit-for-purpose rule-making will likely take years.

Given the state of the market, the SEC should first focus on incentivizing good practices and providing expedited guidance as well as an opt-in path to facilitate token distributions. Though still in design mode, the GTM Framework would be positioned to provide a host of paths to market for tokens that have use cases without the frictions of a ‘securities designation’.

This GTM Framework would do so by proposing, at a high level,

(i) an immediate go to market relief framework (collectively, the “Interim Relief Framework”) through a combination of:

(A) 2025 Safe Harbor Framework. An opt-in safe harbor outside of securities laws for certain eligible token distributions, which includes (i) transaction by transaction relief, (ii) transition relief for historical distributions (the “Transition Safe Harbor”), and (iii) an exit reporting test that provides non-securities status broadly to the eligible tokens upon meeting the conditions.

(B) Expansive Relief. No action relief and/or exemptive guidance for airdrops, asset classes and other additional distributions and transactions outside of securities laws, and

(C) Exemptive Offering Framework adapting existing Jobs Act crowdfunding exemptions as ‘opt-in’ safe harbors for a variety of pre-token offerings, token distributions and marketing airdrops.

(ii) suggesting ways to create positive feedback loops through the interaction of the Relief Framework, including how we might expand and update the Interim Relief Framework on a regular basis,

(iii) providing guidance to incentivize, or at the least, not penalize good disclosure practices and begin to standardize disclosure around the tech — both within and without the context of a token distribution (“Disclosure Framework”), and

(iv) building a broader framework for transition relief to a more permanent end state that marries with the foregoing and engage in rulemaking for a more fit for purpose framework (the “Token Exemptive Framework”).

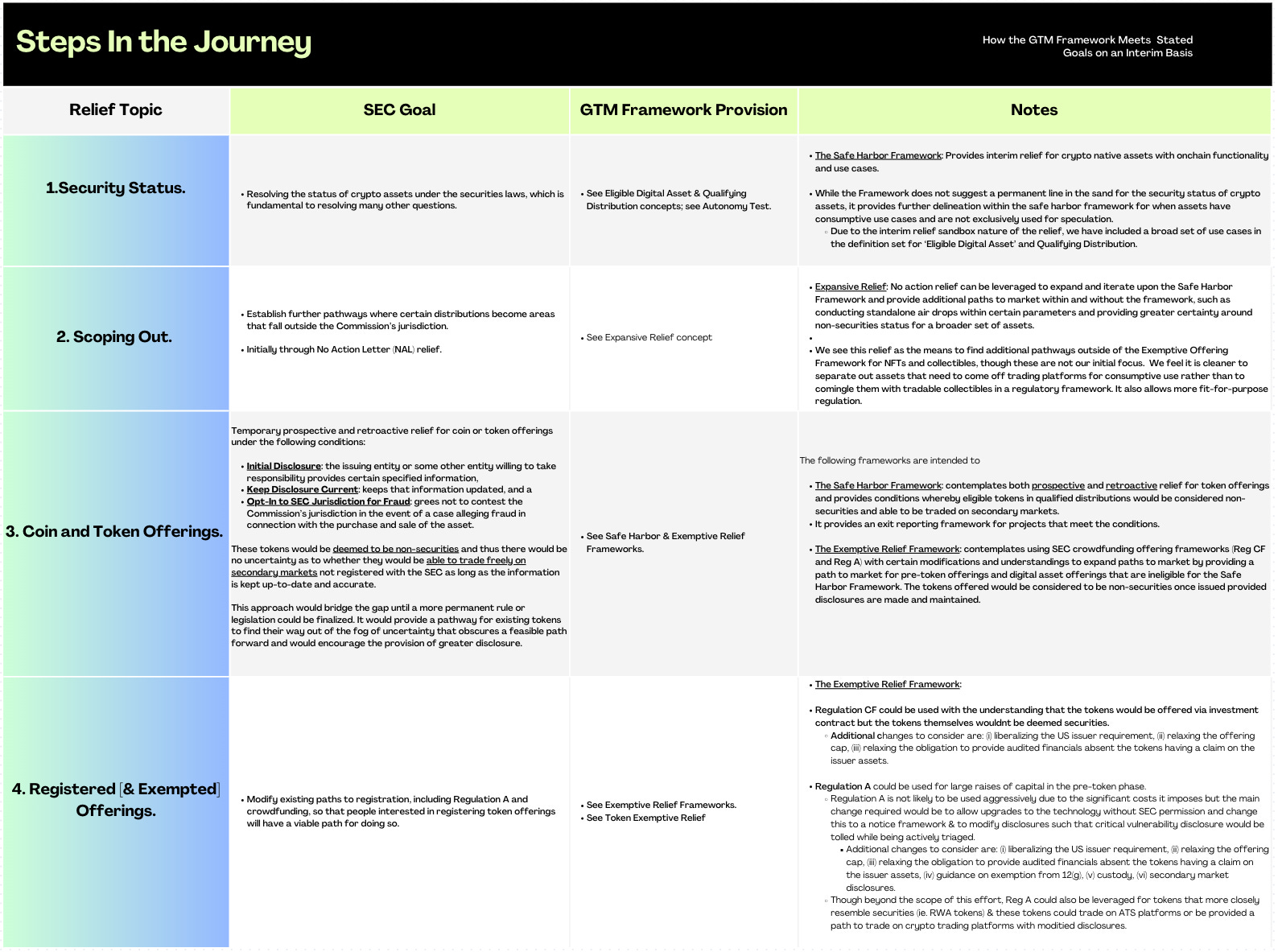

The GTM Framework matches up against stated SEC goals as follows. Certain Terms used but not defined in the following chart can be found in Appendix A: Definitions below.

II. Interim Relief Framework Overview.

(i) Components.

(A) 2025 Safe Harbor Framework. An opt-in safe harbor outside of securities laws for certain eligible token distributions, which includes (i) transaction by transaction relief for new distributions, (ii) opt-in retroactive relief and transition framework for historical distributions (the “Transition Safe Harbor”), and (iii) an exit reporting test that provides non-securities status broadly to the eligible tokens upon meeting the conditions. Key features are as follows:

Initial Eligibility Test: Designed for or crypto native assets with onchain functionality and use cases. See below definitions of Functional System and Eligible Digital Asset.

Scope of Distributions Covered: Public distributions that would otherwise implicate Section 5 liability (inclusive of ICO style sales, listings, airdrops and End User Distributions (see defined term). At the outset, the framework would cover all distributions but through Expansive Relief, transactions that are more removed from a capital raise could fall outside of the framework while retaining higher requirements involves a financial transaction with the exchange of funds to an issuer (directly or indirectly) for the purchase of the Eligible Asset or transactions otherwise designed to create a public market in the asset. The proposed categories and draft requirements are set forth below:

Transition Relief: the Transition Relief Safe Harbor would provide an opt-in for past distributions in exchange for reporting and good faith efforts to comply with the other requirements. It allows projects with past distributions a path for retroactive relief, which in turn is an eligibility condition to opting-in to future relief in the token in question.

Design Decisions: the goal is distinguish between new distributions & transition relief.

Instead of offering a three-year grace period for all, including new projects going to market, the eligibility for the safe harbor should be measured at the time of the contemplated distribution.

For projects that meet the requirements, the safe harbor is available, as currently contemplated.

Existing projects that have done distributions of pre-functional tokens but now seek to meet the Eligible Digital Assets and Functionality requirements would have a [3] year transition period available to do so provided they opt-in and engage in good faith efforts to produce disclosures (which will not be held against them).

Rationale: we have so many cats out of the bag, we have been in a ‘safe harbor’ from good practices for years and we want to immediately incentivize good practices for new and existing teams while not penalizing either.

Open Questions:

What happens to tokens that adhere to stated lockups. A big open question is how we create good incentives among insiders selling tokens.

One thought is to use a ‘restricted token’ concept whereby, borrowing from Rule 144 concepts, if an Affiliated Person were to hold the tokens for a 12 month minimum lockup and then were to sell the tokens to a Restricted Token Holder in a private placement (accredited or QIB) who then was required to hold the tokens for an additional 12 month period, the Restricted Token Holder could then avail themselves of the non-securities designation of the safe harbor.

The same type of framework would need to cover transactions among affiliates in the issuer group and compensatory issuances of tokens to independent service providers as well as 701 style grants of tokens.

Scope of Grandfathering: the scope of the safe harbor as it applies to tokens distributed outside of these distribution categories, including team sales. Should teams only get relief for their past public distributions such that they still need to work toward exit reporting to have full safe harbor coverage?

Would the framework require lockup commitments (even prorated) to be followed between any previous distribution and future contemplated ones?

Scope for ineligible Digital Assets: whether ineligible Digital Assets should be able to avail themselves of this framework and to what extent

how to think of the safe harbor coverage for tokens that will never meet the exit test for the Safe Harbor.

How to address newly discovered open questions and issues:

Expanisve Relief to address these and future edge cases.

Including providing an actual ‘come talk to us’ path as a catch all in the interim.

Ensure all paths (transition or otherwise for the same types of assets) feed into a unified set of conditions to exit reporting framework.

Exiting the Safe Harbor: Using a similar concept as Safe Harbor 2.0, the 2025 Safe Harbor implements the following conditions to exiting the reporting regime:

Opting-in for past distributions by another issuer group is only really likely in the context that the Autonomy Test is met.

(B) Exemptive Offering Framework. This prong focuses on adapting existing Jobs Act crowdfunding exemptions as ‘opt-in’ safe harbors for a variety of pre-token offerings or distributions of tokens that are ineligible for the safe harbor as well as marketing airdrops. The tokens offered would be considered to be non-securities once issued provided disclosures are made and maintained. These offerings more overhang, cost and complexity than a Safe Harbor and so would be used for less clean cases.

Regulation CF could be used with the understanding that the tokens would be offered via investment contract but the tokens themselves wouldnt be deemed securities.

Regulation CF could also be used for marketing airdrops

Additional changes to consider are: (i) liberalizing the US issuer requirement, (ii) relaxing the offering cap, (iii) relaxing the obligation to provide audited financials absent the tokens having a claim on the issuer assets.

For marketing airdrops, lifting the caps on participation by retail investors would also be beneficical.

Regulation A could be used for large raises of capital in the pre-token phase.

Regulation A is not likely to be used aggressively due to the significant costs it imposes but the main change required would be to allow upgrades to the technology without SEC permission and change this to a notice framework & to modify disclosures such that critical vulnerability disclosure would be tolled while being actively triaged.

Additional changes to consider are: (i) liberalizing the US issuer requirement, (ii) relaxing the offering cap, (iii) relaxing the obligation to provide audited financials absent the tokens having a claim on the issuer assets, (iv) guidance on exemption from 12(g), (v) custody, (vi) secondary market disclosures.

Though beyond the scope of this effort, Reg A could also be leveraged for tokens that more closely resemble securities (ie. RWA tokens) & these tokens could trade on ATS platforms or be provided a path to trade on crypto trading platforms with moditied disclosures.

(C) Expansive Relief. No action relief & guidance for airdrops and other additional distributions and transactions outside of securities laws:

Expanding Existing Paths: Building off of Safe Harbor 2.0 as a base, we would suggest that the first iteration contain the following updates as well as a commitment from the Crypto Task Force to:

Review the Relief Framework at least annually and provide guidance/learnings on a continual basis;

Creating New Paths thru Expansive Relief: Allow projects to follow NAL guidance in combination with the below & maintain an open door policy to accommodate new facts outside the contemplated parameters of the Relief Framework.

It would also be worthwhile to analyze the extent the framework harmonizes with MiCA and how we construct reciprocity regimes from here.

This interim relief amounts to a sandbox - the SEC should the combined effort to inform and arrive at a rulemaking effort that is fit for purpose.

III. Design Decisions.

Updating the Safe Harbor 2.0 Constructs to Reflect Market Developments & Updated Definition Sets to Match FIT21 Definitions (where possible).

Following a number of conversations around how we might incorporate L2s and modular blockchains into the GTM Construct, an important update to Safe Harbor 2.0 lies in the updates around the basic definition sets to match FIT21 definitions and expand the existing definitions around blockchain networks to also include protocols and the combined term ‘blockchain system'.

The framework is generally designed to row the same way with FIT21 and have obligations that mirror but are more permissive than FIT to reflect where these projects are in the maturity/development cycle. These obligations are designed to scale from here.

Defining the Eligibility Perimeter. While it is worth debating whether enterprise chains should be eligible for a safe harbor aimed at encouraging network effects and open participation, it is appropriate to encourage opt-ins and reporting using as wide a funnel as possible. Instead, the goal of the GTM Framework is to build the safe harbor around tokens with use cases (as those are the only tokens that would need the aforementioned network effects) while finding as many alternative paths to market as possible for inegible tokens.

Updated Exit Test. Previously, there were two exit tests where decentralized projects were at the disadvantage of needing to reach ‘network maturity’ and the decentralization factors. There were a number of issues with the test, including that decentralization as a goal wasnt defined well, it provided higher hurdles for exit instead of equal treatment and skewed incentives as it disincentivized continued development of these networks. The exit test should be revised to ensure all safe harbor participants are rowing toward the same target. The goal is to ensure ‘network maturity’ through ensuring a level of autonomy and otherwise focusing on elements of control by the initial development team while providing discrete targets where meeting them is a binary (y/n) analysis.

One lesson from history is that a teams’s compliance should depend on what the development team can reasonably control, rather than external market factors.

Incentive Design. The framework is generally designed to maximize opting-in to good practices.

All elements of the framework incentivize increased disclosure and transparency.

Limiting the application of securities status on tokens as a force function for centralization and a force that prevents tokens from being able to fulfill use cases in the hands of users. The relief frameworks provide a reprieve from these incentive structures while preserving investor protection in a scaled manner reflective of the relative risks of a given distribution.

It makes available a self-sorting exercise whereby it establishes at the beginning a perimeter for enforcement where ‘good actors’ are able to show good faith actionable efforts toward compliance in an immediate way.

It begins to delineate a responsibility division between developers and secondary market actors. Developers should not be responsible for ensuring large passive holders sell their tokens nor should they be included in the initial developer group absent governance rights and/or access to MNPI. While secondary market governance will likely remain unaddressed until listing frameworks or future legislation, these obligations belong on the actors engaging in the behavior rather than imposing obligations on developers. To this end, I have begun to construct some definitions for secondary market actors within the below definition set.

APPENDIX A - DEFINITIONS

Shared Definition Sets [Updating Safe Harbor 2.0 Against the Below Terms from FIT21].

AFFILIATED PERSON.— means a person (including a related person) that—(i) with respect to the Issuer Group meets the following (or has within the previous 3 month period) —

(I) directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such such member of the Issuer Group (as applicable); where “control” is defined as directly or indirectly possessing the power to direct or cause the direction of management and policies, whether through ownership of voting securities, by contract or otherwise; or

(II) (a) Any relative or spouse of such person, or any relative of such spouse, any one of whom has the same home as such person;

(b) Any trust or estate in which such person or any of the persons specified in paragraph (I) of this section collectively own 10 percent or more of the total beneficial interest or of which any of such persons serve as trustee, executor or in any similar capacity; and

(c) Any corporation or other organization (other than the Issuer Group) in which such person or any of the persons specified in paragraph (I) of this section are the beneficial owners collectively of 10 percent or more of any class of equity securities or 10 percent or more of the equity interest.

BLOCKCHAIN.—The term ‘blockchain’ means any technology— (A) where data is— (i) shared across a network to create a public ledger of verified transactions or information among network participants; (ii) linked using cryptography to maintain the integrity of the public ledger and to execute other functions; and (iii) distributed among network participants in an automated fashion to concurrently update network participants on the state of the public ledger and any other functions; and (B) composed of source code that is publicly available.

BLOCKCHAIN PROTOCOL.—The term ‘blockchain protocol’ means any executable software deployed to a blockchain composed of source code that is publicly available and accessible, including a smart contract or any network of smart contracts.

BLOCKCHAIN SYSTEM. — The term ‘blockchain system’ means any blockchain or blockchain protocol.

DIGITAL ASSET.—Any digital representation of value that can be exclusively possessed and transferred, person to person, without necessary reliance on an intermediary, and is recorded on a cryptographically secured public distributed ledger or similar analogue.

DIGITAL ASSET ISSUER AFFILIATE.—means (i) any other Person that (a) receives a license or assignment of any material intellectual property from the Digital Asset Issuer (including, without limitation, any trademarks owned by the foregoing); (b) uses intellectual property that the Digital Asset Issuer has released under any free software or open source license to effect a sale or other issuance of Digital Assets, and any officer or key employee of the Digital Asset Issuer is rendering (or has rendered) material services to such Person, or (if an entity) any officers or key employees of the Digital Asset Issuer owns a direct or indirect interest in such Person; or (c) is designated or otherwise granted rights by the Digital Asset Issuer or an Affiliate to such Person to administrate, control, manage or operate (in lieu of the Digital Asset Issuer or such Affiliate) the Blockchain System to which the Digital Asset relates. For the avoidance of doubt, if the issuance of Digital Assets is completed by an anonymous or unidentified person or is agreed upon by a decentralized group of validators or network or Blockchain System participants, the Digital Asset Issuer Affiliate shall be deemed to be the person described in the immediately preceding sentence that has either (a) nominated the genesis block of the Blockchain System, or (b) been the primary developer of the differentiated intellectual property that is utilized by or in connection with the Blockchain System

DIGITAL ASSET ISSUER.— means (i) any person that, mints, generates, creates and issues or causes to be minted, generated, created and issued a unit of such digital asset to a person; or (ii) offers or sells a right to a future issuance of issuance of a unit of such digital asset to a person facilitate an arrangement for the primary purpose of effecting a sale, distribution, or other issuance of a digital asset.

EXCLUSION.—The term ‘digital asset issuer’ does not include any person solely because such person deploys source code that creates or issues units of a digital asset that are only distributed in end user distributions.

END USER DISTRIBUTION.— means an issuance of a unit of a digital asset that—(i) does not involve an exchange of more than a nominal value of cash, property, or other assets; and

(ii) is distributed in a broad, equitable, and non-discretionary manner based on conditions capable of being satisfied by any participant in the blockchain system, including, as incentive-based rewards— ‘‘(I) to users of the digital asset or any blockchain system to which the digital asset relates;

(II) for activities directly related to the operation of the blockchain system, such as mining, validating, staking, or other activity directly tied to the operation of the blockchain system; or

(III) to the existing holders of another digital asset, in proportion to the total units of such other digital asset as are held by each person.

FUNCTIONAL SYSTEM.—With respect to a blockchain system to which a digital asset relates, the term ‘functional system’ means the network allows network participants to use such digital asset for—

(A) the transmission and storage of value on the blockchain system;

(B) the participation in services provided by or an application running on the blockchain system; or

(C) the participation in the decentralized governance system of the blockchain system.

ISSUER GROUP.— means the Digital Asset Issuer and any Digital Asset Issuer Affiliates.

LARGE HOLDER.— means any person who (I) beneficially owns 2 percent or more of the units of such digital asset that are then outstanding; or ‘(II) was described under clause (I) at any point in the previous 3-month period.

RELATED PERSON.—means, respect to any member of the Issuer Group — (A) a founder, promoter, employee, consultant, advisor, or person serving in a similar capacity;

(B) any person that is or was in the previous 6-month period an executive officer, director, trustee, general partner, advisory board member, or person serving in a similar capacity (collectively “Knowledge Group Members”);

RESTRICTED HOLDER.—means, with respect to holders of Digital Assets:

(A) Related Persons;

(B) any equity holder or other security holder of any member of the Issuer Group; or

(C) any other person that received a unit of digital asset from such digital asset issuer through— (i) an exempt offering, other than an offering made in reliance on the Safe Harbor or the Exemptive Offering Framework; or (ii) a distribution that is not an End User Distribution.

Notes on draft: this draft is being circulated for comment (widely) - if you have constructive comments/feedback, please feel free to reach out to me to discuss.