Omnibus Legislation & The Fraught Case for A Unified Market.

A Token Taxonomy Informed Regulatory Model.

This article builds on my piece about must haves for any first mover crypto-specific legislation - which warns against the current legislative focus.

To put it plainly, CEA based trading frameworks fail to address any fundamental needs we have for legislative accomodation on the merits. I continue to believe we should use this reprieve to truly go back to the drawing board —

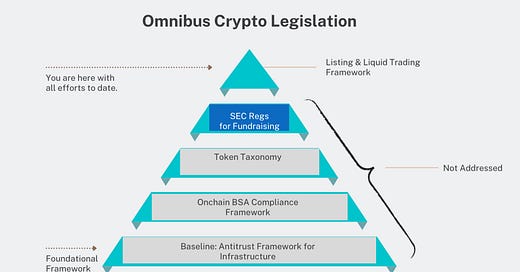

Any first-mover omnibus legislation should focus on structural concerns, particularly for decentralized tech rather than attempt to regulate distinct digital assets in an omnibus fashion.

But since we insist on focusing at the top of the pyramid, when it comes to token regulation, I don’t believe new legislation is needed to address issues caused by agency overreach or failure to issue guidance. The SEC is the natural regulator of fundraising activities, and much of the market activity we see in tokens is fundamentally about capital raising. As there are arguments of varing strengths why different tokens might be securities under current law—legislative accomodation would be helpful for value accruing crypto native assets, as discussed below. Others, from a policy standpoint, are rightfully within the purview of the SEC — particularly those tied to the marketing and appreciation of centralized ecosystems. It’s vital to acknowledge this rather than perpetuate the fiction that tokens are categorically not securities.

You cannot escape the reach of the SEC through efforts like FIT. House ag does not have the power to redefine the out limits of the definition of a ‘security’ under law. So, barring some action by Senate Banking with respect to token taxonomy, if you would like to solve for the issues created by the SEC, you need to do so at the SEC.

As it stands, even if the SEC admits that certain "gas tokens" (like Ethereum) aren’t intrinsically securities, the SEC would still have grounds to regulate fundraising activities involving these tokens. From a policy perspective, centralized projects deriving value from token price appreciation pose conflicts similar to those in traditional equity markets as well as novel & distinct risks. Addressing these might require a dual registration regime, where both the token and equity models are disclosed and regulated, particularly around areas like material non-public information, ‘control’ and governance.

Ultimately, the ‘industry lobby’ will undoubtedly produce a path for projects like Ripple or hypothetical token models like "Apple Coin," due to the amount of effort and monetary resources being poured on the issue. But without distinct regulation to address the moral hazards posed by a token serving as both a fundraising instrument and a value accrual mechanism distinct from equity, we risk undermining traditional equities markets with the only value prop being regulatory arbitrage. The lack of shareholder protections and the absence of contractual obligations in token issuances also raise important questions about their societal value relative to traditional equity-based frameworks.

Since we insist on the top of pyramid focus, this article imparts some facts on the ground and undertakes a sorting exercise for how policymakers should address tokens & token markets.

A MODEL FOR THE ONLY THING POLICYMAKERS SEEM TO CARE ABOUT: TOKENS AND TRADING THEM

I put together a mental model to assess whether agencies or Congress are the better avenues for handling issues around tokens and their trading. The SEC’s role is to help private actors bring products to market and structure fundraising efforts without evaluating the merit of these products — in other words, building on this thought piece, the SEC is (at least designed to be) merit-neutral. Congress, however, is not merit-neutral; it is tasked with evaluating the societal value of the legislative efforts it puts forth. This process is subjective and often skewed towards the interests of centralized, powerful actors, especially post-Citizens United.

Addressing the SEC’s dysfunction through Congressional intervention isn't practical because Congress isn’t designed to get into the details of regulatory frameworks. As Sheila Warren pointed out on a recent episode of Laura Shen’s podcast, Congress is messy and dysfunctional, and we can’t expect it to get everything right. Instead, Congress should operate at a high level, setting broad rules for technologies that operate differently than existing models (like Big Tech and platform economies) and deciding which regulator should oversee them while creating more granular rules.

Regarding current legislative efforts, we must reject the notion of "one-size-fits-all" legislation that treats vastly different digital asset classes as though they were the same asset. As seen in 2018, tokens that took on multiple asset characteristics were simultaneously regulated by multiple regimes, causing incoherence. Gas tokens with revenue-sharing elements or platform currencies with voting rights led to conflicting regulatory treatment. By the same notion, pretending tokens dont have distinct characteristics for the sake of a unified framework, is equally fraught. Also, because tokens are composable and can change their intrinsic characteristics, regulation of digital assets by taxonomy must be informed by fact and should focus on their intrinsic characteristics, not just on superficial classifications if we have any hope of coherence in a regulatory regime.

Token Taxonomy - A Mental Model for a Legislative Framework:

When discussing tokens, there’s a spectrum that exists from crypto-native assets to onchain traditional securities products. You dont get to slap a blockchain on tokenized equity and opt out of securities laws for the sake of a ‘unified market structure’. Each of these asset classes requires a different regulatory approach.

Broad Categories:

Crypto-native assets: Tokens that will require different levels of regulatory accommodation depending on their intrinsic characteristics & use. Section II makes the case for accomodations from securities laws based on intrinsic characteristics.

--> These could be in the form of an SEC Safe Harbor, as proposed by Commissioner Pierce & built upon by efforts such as Regulation X.

--> They could also be legislatively crafted, as suggested here.

NFTs: PSA: we need to recognize that NFTs are not an asset class, and more granular definitions are necessary for this group. This is a broad category of digital assets that signify distinctiveness or a lack of interchangeability such as distinct collectibles or titled assets.

--> For digital collectibles, in-game assets, unless they include revenue-sharing features or fractional ownership, NFTs should generally be outside securities regulation. We should have a consumer-facing regulator oversee the platforms where NFTs are traded.

--> For revenue or royalty bearing NFTs, the path forward is more akin to the path for tokenized equity & titled equity-like products.

Tokenized Bearer debt instruments: These could include tokens representing revenue streams from centralized enterprises or fungible tokens representing debt instruments.

--> These would require legislative accomodation (if deemed worthy of it) because bearer debt instruments are actively discouraged under current laws such as TEFRA.

--> A legislative path forward for this category could well include tokens issued by centralized issuers being treated as a sort of non-recourse bearer debt offering while establishing disclosure regimes to protect token holders as well as existing and future equity holders.

Onchain traditional securities: These traditional securities, once put onchain, need regulatory accomodation for a clearer path to market & for the underlying infrastructure to be built out. This concept has been explored by Commissioner Pierce in her pilot program proposal for a distributed ledger technology (DLT) sandbox between the US and the UK.

The key questions are: what accommodation is needed and should this accommodation come from regulators like the SEC, or should it be legislated by Congress? Beyond taxonomy, we must also regulate based on use.

Securities laws are currently a force function pushing the creation of valueless tokens.

To wrap up, the lessons this piece intends to impart are that:

We need to stop perpetuating the fallacy that all tokens are in the same asset class as it can only lead to poor outcomes.

We need legislative relief for crypto-native value-accruing tokens within decentralized models but that’s just the beginning. Beyond taxonomy, the goal for a token framework should be to create a safe harbor and regulatory structure for token issuances that pursue decentralized models aimed at rewarding and perpetuating user economies.

While crypto’s killer use case should be something distinct and apart from speculating on trading platforms. For crypto-native assets, we need a fundraising-to-public-distribution framework that acknowledges the peer-to-peer nature of these assets. The SEC has an important role in this, particularly in creating a framework for issuer distribution mechanisms. This involves defining the SEC’s jurisdiction limits and establishing a listing pathway for non-securities markets.

Further, if you gave FTC cradle to liquid market oversight, you might actually arrive at a unified (omnibus) regulatory regime that is better positioned to be responsive to crypto native use cases for the tokens outside of trading on CEXes.

Lastly, there is much work to be done beyond crafting listing and trading legislation, we need structural supports for that market together with regulations that wrap around the varying use cases — this trading framework will inherently need to be distinct from that applied to onchain securities products or digital collectibles.

great points here! 10/10